Q4 2020

Description: At Milltrust, we have developed proprietary geographical asset allocation models that help drive the country allocation recommendations for our equity investment solutions. The models are based on a scoring mechanism that compares and evaluates the attractiveness of each country using quantitative investment factors that have been shown to convey information about future equity returns. This allows us to tilt the portfolios towards the countries and regions that provide a more favourable environment with the goal of enhancing dollar returns of unhedged global equity portfolios. This is a systematic process.

Strategy: Milltrust Global Emerging Markets Equity Strategy

Investment Universe (core – 10 countries): China, Taiwan, India, South Korea, Thailand, Malaysia, Indonesia, Brazil, Russia and South Africa.

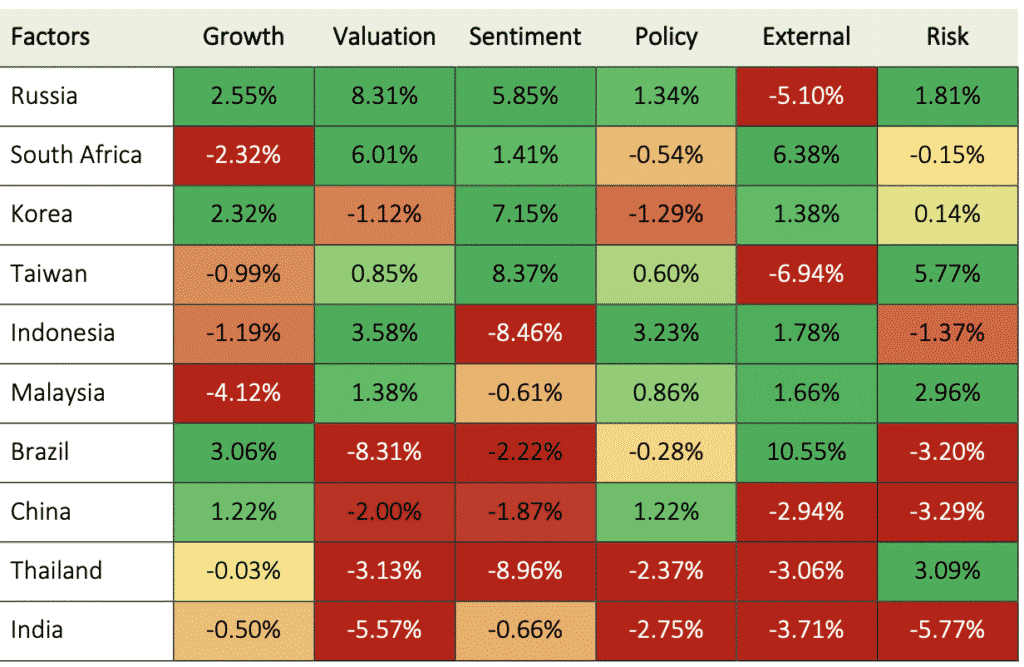

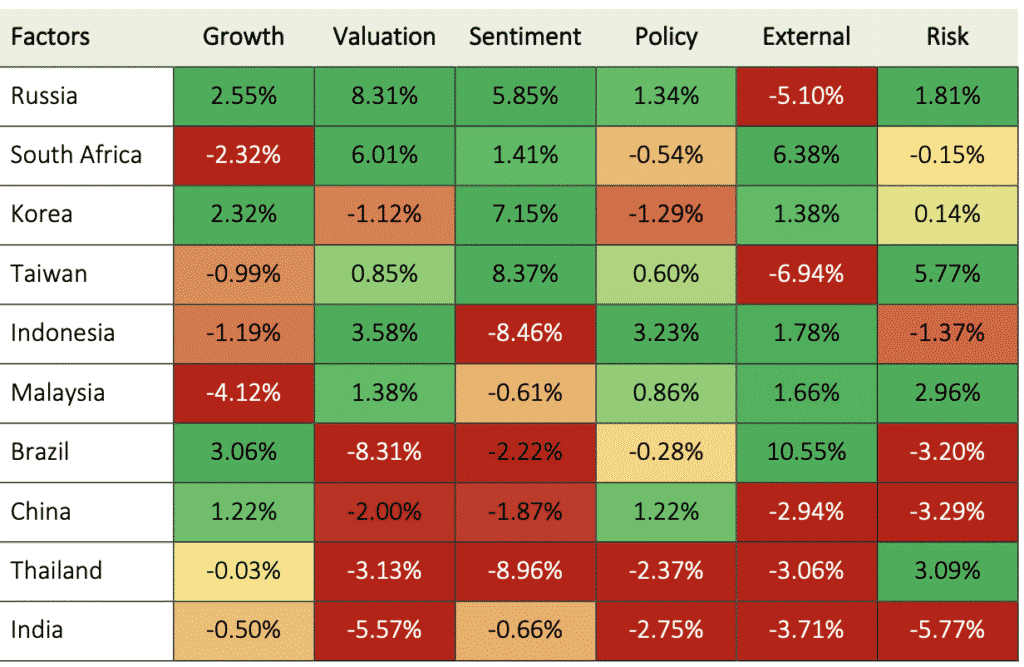

Summary: Compared to the previous quarter, there has only been one change in the country rankings with Indonesia moving from an underweight to neutral allocation in an Emerging Markets portfolio. The East Asian markets of South Korea and Taiwan continue to appeal as they benefit from the China rebound and the uptick in global growth. Both have demonstrated a clear economic rebound and superior earnings momentum. Meanwhile Russia and South Africa offer the best value play in the asset class with both remaining overweights. Thailand and India remain at the bottom as underweights with negative headwinds facing both countries.

Highlights:

Overweight: Russia, South Korea, South Africa and Taiwan

Although the gap has narrowed at the top, Russia does remain the top ranked country in our model with the double benefit of offering attractive valuations and high dividends; the year-on- year price momentum is also still positive. South Korea is another overweight and has been resilient from a growth perspective with growth forecasts for 2021 improving 80 bps over the last six months. Year-on-year price momentum remains positive, the currency is still undervalued and the terms of trade is trending up. Meanwhile, South Africa offers very attractive valuations with its current forecasted P/E ratio below both the EM average and its own 10-year average. The rand is also undervalued in real terms. Finally, Taiwan’s attractiveness is boosted by their positive price momentum and favourable risk indicators including a substantial current account surplus relative to GDP.

Neutral: Brazil, China, Malaysia, Indonesia

Similar to South Korea, China’s economy is rebounding faster than others with GDP growth forecasts increasing 220 bps for 2021. The authorities still have room to loosen monetary policy with real rates above the EM average. Meanwhile, Brazil’s economic reopening has translated to stronger growth forecasts for 2021, improving 100 basis points over the last 6 months. The currency remains extremely undervalued; however, valuations are relatively expensive versus the other EM countries which adds some valuation risk. Finally, in South East Asia, both Malaysia and Indonesia offer good entry points with attractive valuations and undervalued currencies. Despite the tight conditions in both countries, interest rates have come down in line with the EM average and both still have relatively high real interest rates to work with.

Underweight: India, Thailand

India’s domestic growth has seen significant downgrades to its 2021 growth forecasts which is well below the EM average. Valuations are expensive with India’s forecasted PE ratio above both its 10-year average and the EM average. Monetary conditions are tight while the country’s terms of trade is trending down. Unlike Korea and Taiwan, India does not benefit as much from the China recovery. Finally, in Thailand, negative price momentum, still expensive valuations, and an overvalued currency are creating headwinds for the country.

Scorecard:

Ranked from most attractive to least attractive.

Disclaimer:

For professional investors only. This document is strictly private and confidential and is issued by Milltrust International LLP, incorporated in the United Kingdom, which is authorised and regulated by the Financial Conduct Authority. Milltrust International LLP has its registered office at 5 Market Yard Mews, 194-204 Bermondsey Street, London, SE1 3TQ, United Kingdom and is a subsidiary of Milltrust International Group (Singapore) Pte Ltd.). None of the investment products mentioned herein are regulated collective investment schemes for the purposes of the UK Financial Services and Markets Act 2000. The promotion of such products and the distribution of this document are, accordingly, restricted by law. Most of the protections provided by the UK regulatory system and compensation under the UK’s Financial Services Compensation Scheme will not be available. The investments described herein are only available to investors permitted to invest in the prospectus of the fund and are not available to private investors. The nature of the fund investments carries certain risks and the Fund may utilise investment techniques which may carry additional risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Past performance is not a reliable indicator of future performance. This document contains forward-looking statements which are correct as at the date of this document. Such statements involve known and unknown risks, uncertainties and other important factors that could cause actual results, performance or projections to be materially different from future results. Any investment in the funds mentioned above should be based on the full details contained in the relevant prospectus and supplements which are available from www.milltrust.com. Notice to US investors: the shares of Milltrust International Managed Investments ICAV and Milltrust International Investments SPC have not been registered under the 1933 Securities Act or under the 1940 Act; however the company takes advantage of the 3[C]7 exemption and shares are available to 3[C](1) US qualified purchasers and those qualifying under Reg D distribution activity in the US is undertaken by Silverleaf Partners LLC, a registered broker-dealer based in New York.