In This Week’s Issue…

Key Story

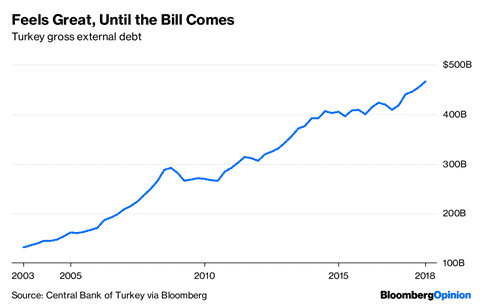

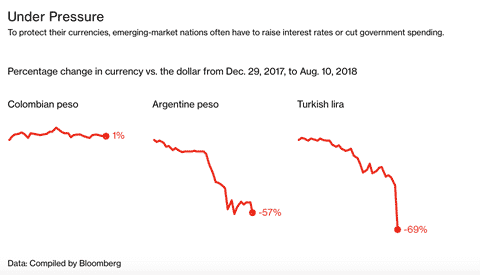

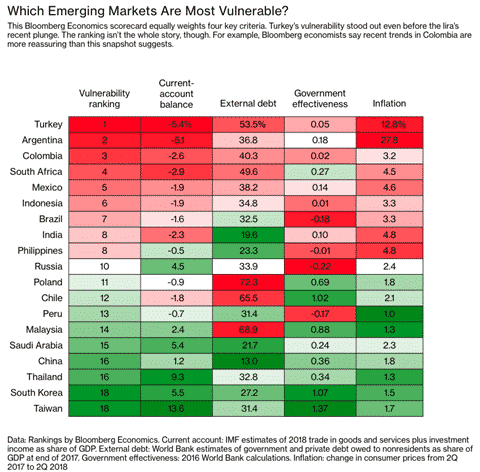

Emerging markets have dropped into bear territory, down around 20% from their January highs, as the impact of Turkey’s currency crisis, a commodity price rout and disappointing results from Chinese tech giant Tencent, which reported its first profit drop in a decade, weighed on sentiment.

Turkey has managed to temporarily stop its currency’s bleeding and while there has been no cooling of tensions with the U.S., President Recep Tayyip Erdogan has moved to shore up alliances in Europe and the Middle East. Today, Turkey’s finance minister sparked a recovery in the lira after he addressed thousands of international investors, pledging to protect beleaguered local banks and cut public spending to prevent the country defaulting on its loans.

The crisis in Turkey is nevertheless moving asset prices across emerging markets. The MSCI Emerging Markets Currency Index has fallen to the lowest in over a year. Yet, despite all of Turkey’s woes, economists are confident that the crisis will not trigger a full-blown crisis across the emerging markets.

Key Feature

We remain positive on the growth prospects of ASEAN economies this year which we think will continue to be driven by the two main economic factors of fiscal policy support and spending and consumption especially with the spill over from exports growth to domestic demand.

On the other hand, markets have been volatile due to trade wars concerns, higher interest rates, stronger USD and risk aversion to emerging markets. Valuations are now far less demanding with ASEAN trading below its historical price-to-earnings ratio average of 15x. We continue to take this opportunity to add to companies that are more domestic focused and less impacted by external factors. The key risks remain a) peaking global growth; b) China policy risks; c) faster than expected inflation leading to higher interest rates; d) trade wars and protectionism.

Key Investment

OneSmart is a leading K12 afterschool tutoring service provider in China focusing on the premium market, commanding an ASP of over Rmb 250/teaching hour in FY17. Its 1-on-1/1-on-3 class format contributed 88% of revenue in FY17.

The company’s content standardization and established platform/system enabled network expansion, while the superior teaching quality and customized learning plans gave it power for premium pricing. We remain positive with the company.