In This Week’s Issue…

Talks Defuse Trade War

Beijing and Washington sought to defuse an escalating trade war after the Trump administration released the biggest list yet of Chinese goods it may hit with tariff increases. China’s Vice Minister of Commerce Wang Shouwen said “when we have a trade problem, we should talk about it” — alongside fresh threats of retaliation. The move back to the bargaining table matches some willingness from the Trump team to resume talks, according to a person familiar with the administration’s thinking. Both nations stand to lose by erecting barriers. Morgan Stanley estimates that if the U.S. goes ahead with threatened tariffs on $250 billion worth of imported Chinese goods, the hit to American growth would be around 0.3 to 0.4 percentage point and, for China, it could constitute a drag of 0.3 percentage point.

India Beats France for 6th Place

India is moving up in the coveted list of the world’s largest economies. According to World Bank data, last year, the country became the world’s sixth largest economy beating France. That’s indeed another good talking point for the ruling Bhartiya Janata Party (BJP) led by Narendra Modi as the 2019 poll campaigns approach. But, this muscle growth was bound to happen anyway due to India’s consistent growth pace over the years.

Milltrust ASEAN Outlook

We remain positive on the growth prospects of ASEAN economies this year which we think will continue to be driven by the two main economic factors of fiscal policy support and spending and consumption especially with the spill over from exports growth to domestic demand. Markets have been challenging last month mainly due to trade wars concerns, higher interest rates and USD and general risk aversion from emerging markets. ASEAN fundamentals have largely improved since 2015 so the economies are better placed to withstand these external concerns. However, we recognised that volatility and flows will continue to impact the ASEAN markets. Valuations are now less demanding after the market correction with ASEAN trading below its historical PE average of 15x. We are taking the opportunities created by the increased volatility to increase our exposure to companies that are more domestic focused especially domestic consumer companies that should be more resilient and less impacted by external factors. The key risks remain a) peaking global growth; b) china policy risks; c) faster than expected inflation leading to higher interest rates; d) trade wars and protectionism.

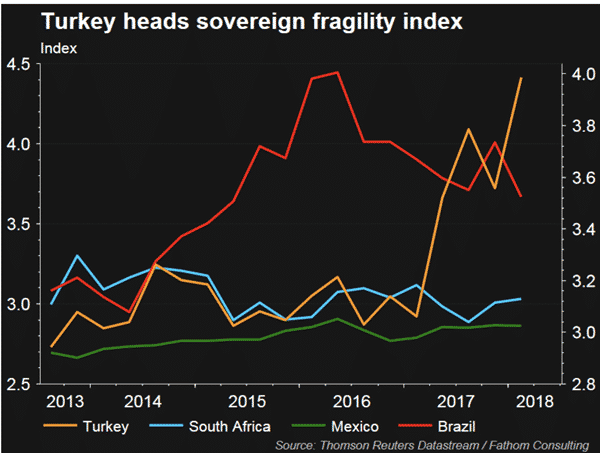

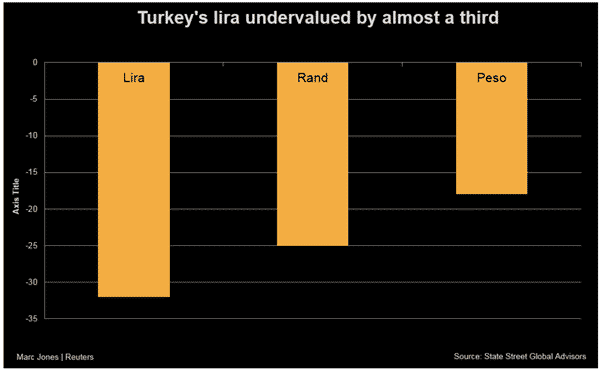

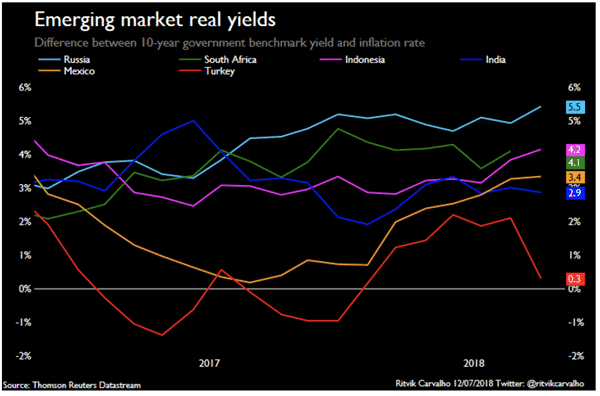

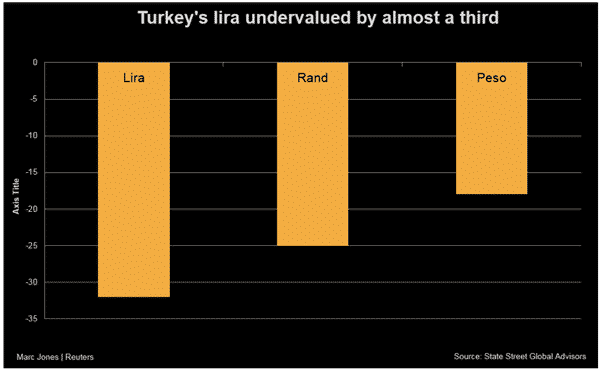

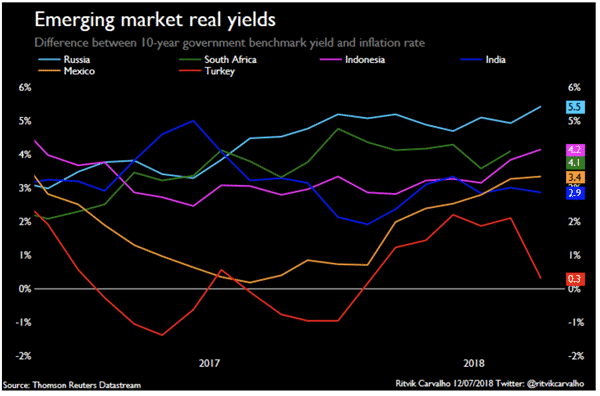

Currencies in Mexico, Turkey Diverge After Vote

For investors in Mexico and Turkey, the devil they didn’t know is proving far more palatable than the one they thought they did. Since the elections, though, markets have cheered the Mexican leftist known as AMLO and delivered a thumbs down for Erdogan. The peso, which lost almost a 10th of its value against the dollar before the July 1 vote, rallied more than 5 percent since then. Turkey’s lira, by contrast, fell over 3 percent since the nation’s June 24 vote, extending this year’s collapse to more than 21 percent.