Now’s the Time to Buy Emerging Markets

Emerging markets are poised to rally after more than $7 trillion in stocks slid into bear territory, according to three of the world’s largest money managers. Strategists and investors from Goldman Sachs Group Inc., Franklin Templeton Investments and BlackRock Inc. say cheap prices, rising corporate profits and strong fundamentals will outweigh risks from a tit-for-tat trade war, rising interest rates and potential U.S. recession.

Risk-on

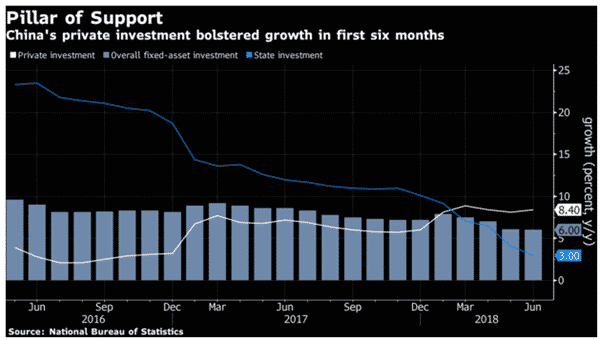

Chinese financial markets are rising as investors rediscover their appetite for risk in the wake of government moves to stimulate the economy. The offshore yuan continued to slide, trading at 6.4 to the dollar, its weakest level in more than year in the wake of a record injection of funding to lenders by the People’s Bank of China. The rally in stocks still faces major headwinds, not least the continuing trade dispute with the U.S.

Milltrust China Views

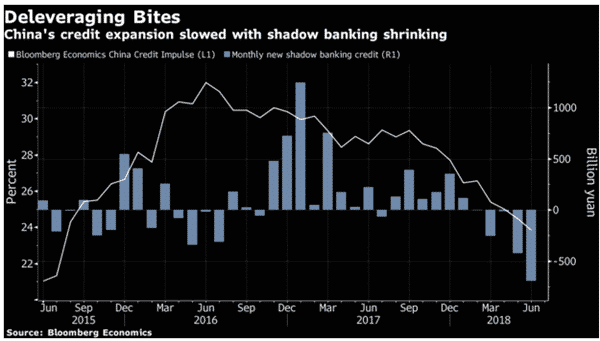

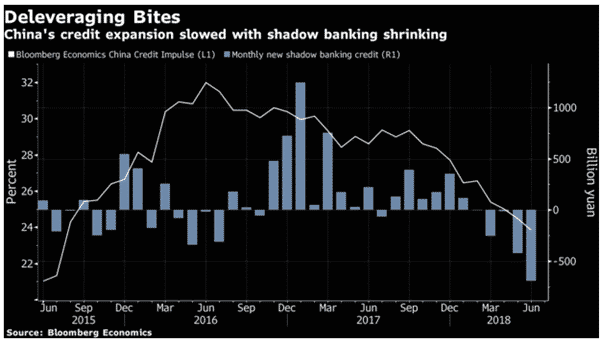

Although there is considerable uncertainty in the market, we think the possibility of a full-blown trade war between the world’s two largest economies is still not very high. We think that both sides are making tactical moves to better position on the negotiating table. With the ongoing de-leveraging process, liquidity conditions in China deteriorated in the month. There were increasing number of reports of debt defaults and P2P platforms collapses in China. Concerns of de-leveraging on the real economy increased and became another source for market volatility om the month. Based on what we have seen, we think that the Chinese government will shift policy stance to stabilize the economy in the short term. We expect loosening monetary and fiscal policy measures in the coming months. While we are not concerned about the short-term economy stability, we are cautious about the impacts of such measures in the medium to long term.

NAFTA Talks Resume

Negotiations for a new North America Free Trade Agreement restart in earnest after stalling ahead of Mexico’s presidential election on July 1. Canadian Foreign Affairs Minister Chrystia Freeland will discuss progress in Mexico today with both the incoming and outgoing administrations, while Mexican Economy Minister Ildefonso Guajardo will be in Washington tomorrow to meet with U.S. Trade Representative Robert Lighthizer. Gaping differences remain have yet to be resolved, including car-trade rules and a sunset clause that would kill the deal after five years.

Milltrust MENA Views

As the corporate result season for 2Q 2018 is upon us we expect downside correction in Kuwait, Qatar, Oman and Bahrain due to overstretched valuations and lack of triggers. Saudi Arabia is likely to remain upward trending due to positive 2Q 2018 corporate result announcements because the largest sectors i.e. petrochemicals and banks are likely to show positive results on the back of stable spreads and NIM enhancements respectively, while Egypt and Morocco may experience a bounce back.

HERE’S WHAT ELSE YOU SHOULD READ