In This Week’s Issue…

Contagion

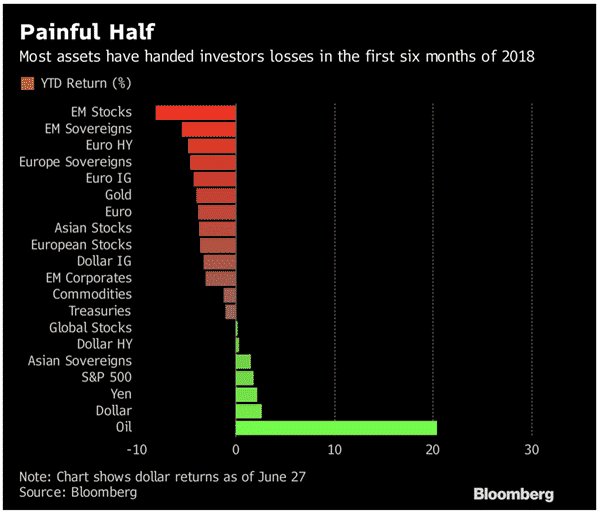

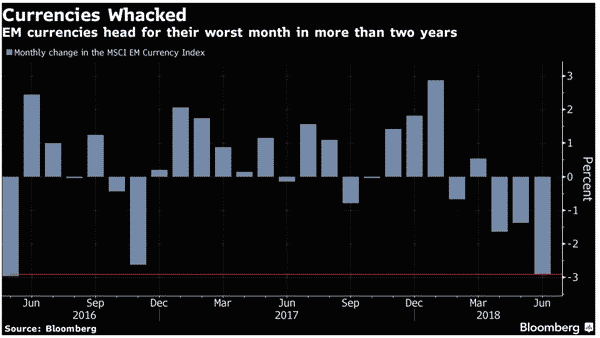

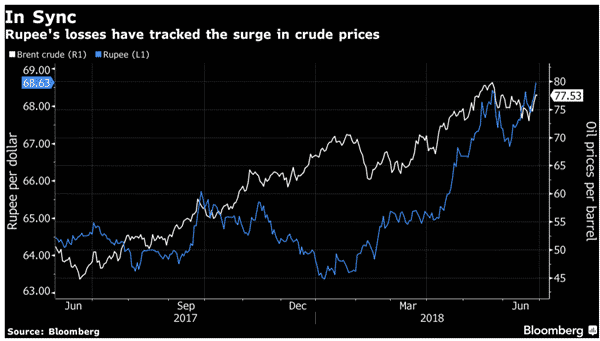

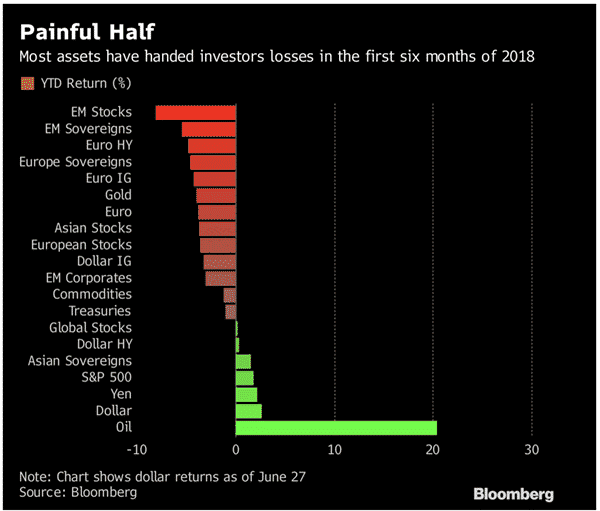

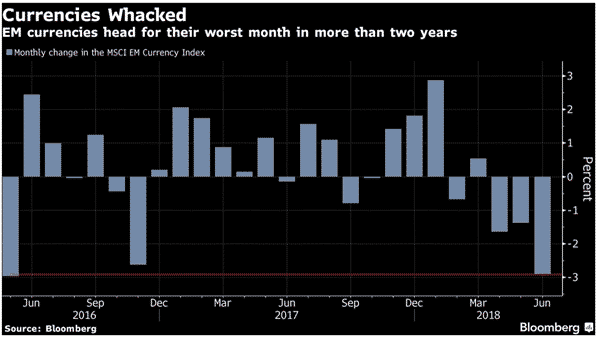

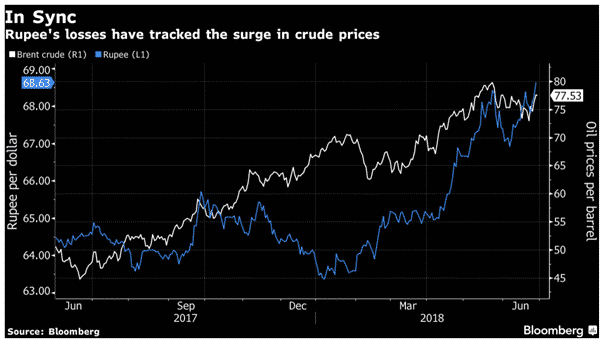

Emerging-market currencies’ bad run continues, with India’s rupee falling to an all-time low against the dollar this morning. The latest setback for the asset class has upended China’s yuan, which has long enjoyed haven status among developing nations. The currency is now at its lowest level since November. MSCI’s index of EM foreign exchange is heading for its worst month since August 2015.

China Opens

China is slowly following through on pledges to open up to foreigners, as an impending trade war with the U.S. focuses attention on Beijing’s grip over doing business in the world’s second-largest economy. On Thursday the government formalized the easing of foreign investment limits on a range of industries from banking to agriculture, updating its so-called negative list of industries where overseas investors are restricted or banned.

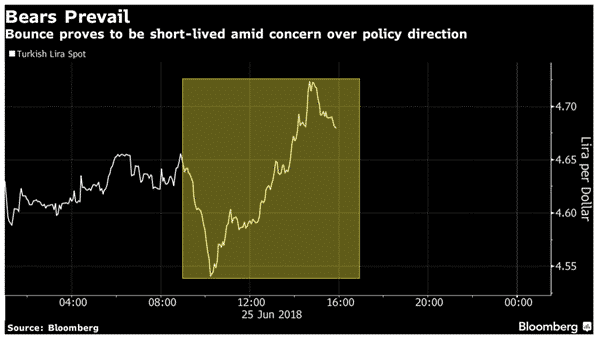

Turkey votes

Recep Tayyip Erdogan won 53 percent in Turkey’s presidential election, avoid him a second-round run off poll to continue as the country’s longest-serving ruler of the modern era. While initial market reaction to the result was positive, with the main Istanbul stock index rising almost 4 percent at the open the following morning, that gauge turned negative as the day progressed, while the lira gave up all its post-result bounce.

MENA Outlook

We expect the regional markets barring KSA to experience liquidity drain as hot money follows the inclusion of KSA in MSCI Emerging Market Index on June 20, 2018. We don’t expect any major trend as the active flows recorded YTD might experience some profit taking. In terms of valuations markets like UAE offer significant upside potential but lack of positive triggers may not let that materialize. Egypt might experience a slow quarter as global oil price rally is digested and Kuwait may witness a brief rally due to MSCI inclusion possibilities.

Mexican Elections

Sunday’s elections for the Mexican presidency and both houses of Congress have the potential to have significant implications for global equities and fixed-income markets. Mexico’s history of turbulence during presidential transitions as well as the peso’s standing as one of the most traded emerging-market currencies should put investors on notice.