WHAT YOU NEED TO KNOW – EMERGING MARKETS

Lam Urges a Return to Order After Protests: Hong Kong Update

Hong Kong leader Carrie Lam urged a return to order at the close of a day that saw police use tear gas to stop protesters from storming the legislative chamber where lawmakers intended to take up a bill allowing extraditions to China. The Legislative Council delayed its debate on the proposal after thousands of demonstrators — most clad in black or white — swarmed the government complex in central Hong Kong, eventually prompting scuffles with police at the chamber doors. The protesters called for Lam to withdraw the bill, which they argue would blow up the legal wall intended to keep the former British colony’s justice system separate from China’s. For all the latest developments, click here.

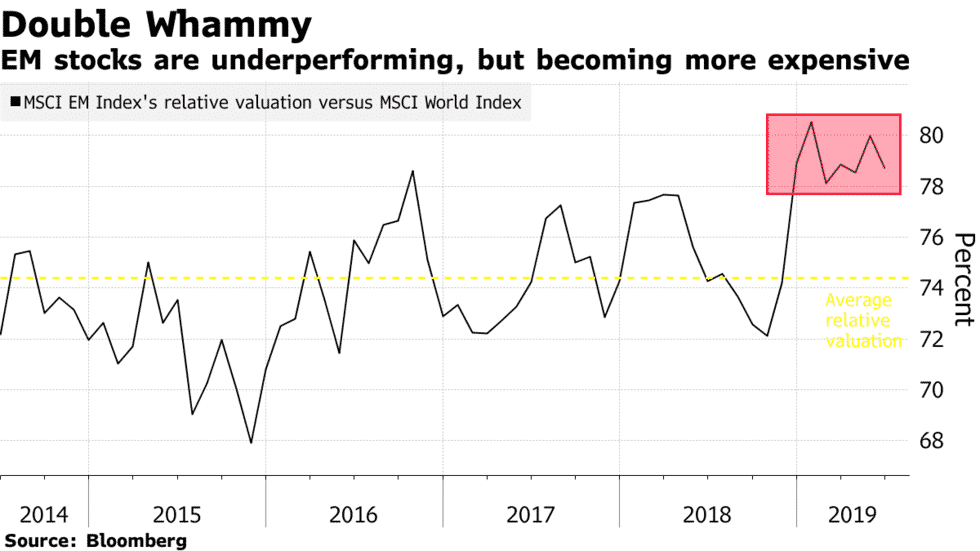

A $17 Trillion Market Runs Out of Bargains

In a double whammy for money managers, emerging-market stocks are underperforming but becoming more expensive. The MSCI Emerging Markets Index has handed investors a loss, including reinvested dividends, of 7.3% in the past 12 months, compared with a 2.1% total return from the MSCI World Index. Yet bargain-hunting opportunities are rare among $17 trillion of beaten-down stocks in the developing world — their relative valuation to developed-nation equities has increased 3 percentage points toward the highest levels in six years. The reason, in a nutshell, is falling earnings.

Defying trade war odds, some Chinese equity funds show how to rake it in

As the Sino-U.S. trade war roiled stock markets over the past year, China-focused fund manager Michelle Leung sat unfazed on her holdings of hot pot condiment maker Yihai International. It was a good call. And not simply because people need to eat whether in good times or bad times. Yihai, whose shares have surged nearly 900 percent over the past two years, are among a handful of high-conviction stocks that helped Leung’s long-only China equity fund shine. In 2018, when the broadening trade war knocked the MSCI China Index down roughly 20%, Leung’s $200 million Xingtai China fund achieved an enviable positive return of 4.9%. During the Jan-April period this year, her fund delivered a return of 30.1%, according to the fund’s latest disclosure. “The trade war is a big issue today,” said Leung, Hong Kong-based CEO of Xingtai Capital, noting the timing of any resolution to the dispute remains uncertain. “No one has information edge on that. But we do have an information edge on the companies we invested in.”

Stock of the Week

Dynagreen Environmental – The DYNAGREEN group is a company group invested by the Beijing Stated-owned Assets Management Co., Ltd., dedicating to the industry of recycling economy and renewable energy with registered capital of RMB 7 billion. Its operation activities covering the investment and construction, operation and management, technology development and supply of the core equipment, and the other professional services including consult of the project regarding the treatment of the urban household waste and medical waste, as well as providing the overall solution for the urban waste treatment.

Could Dynagreen Environmental Protection Group Co., Ltd. (HKG:1330) Have The Makings Of Another Dividend Aristocrat?

Is Dynagreen Environmental Protection Group Co., Ltd. (HKG:1330) a good dividend stock? How would you know? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company’s dividend doesn’t live up to expectations.

Dynagreen Environmental Protection Group yields a solid 3.0%, although it has only been paying for three years. A 3.0% yield does look good. Could the short payment history hint at future dividend growth? When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

WHAT YOU NEED TO KNOW – SUSTAINABLE INVESTMENTS

Do-Good Capitalism Has to Act as If the World Depends on It

Impact investors have deployed $502 billion but it’s only just scratching the surface of the world’s problems.

Climate change, extreme poverty, and all the world’s other big problems will be expensive to solve.

The United Nations estimates that its 17 Sustainable Development Goals—a list of initiatives ranging from zero hunger to clean energy—will require annual commitments of private capital from $5 trillion to $7 trillion globally over the next decade. This daunting task has inspired a growing number of investors to put their money to work. Impact investing, which aims to overcome environmental and social challenges while making a financial return, is one of Wall Street’s fastest-growing asset classes. Since the term “impact investing” was coined in 2007, $502 billion has been invested globally in assets deemed to be making a difference, according to a first-of-its-kind attempt to measure them done this April by the Global Impact Investing Network. The investing style has garnered a cultlike following among the wealthy elite, who see it as an alternative to philanthropy and government initiatives. Capitalism, they say, can solve some of these problems faster by harnessing the power of the markets.

Well-intentioned as these investors may be, their efforts have yet to make a significant dent in any major problems. Foundations, families, pension funds, and asset managers, largely from the U.S., have focused on investments that address climate change or improve access to affordable housing, health care, and education. The challenge is amplifying those efforts. The planet, impatiently, awaits the results.

WHAT YOU NEED TO KNOW – AGRICULTURE INVESTMENTS

Australia braces for another below-average winter crop

Australia is staring down the barrel of another lower-than-average winter crop, as ongoing dry weather hinders planting across the nation, according to Rabobank’s Australian 2019 Winter Crop Outlook, released today.

Although WA bucked the nationwide trend last year by delivering a bumper 17.1 million-tonne crop, that is unlikely to be the case for the 2019/20 harvest given dry conditions so far this year and expectations of a dry winter.

Rabobank said all cropping regions in the Eastern States – as well as South Australia and WA – had begun the season with below-average rainfall, record-low soil moisture and a less-than-favourable rainfall outlook.

It would be “against all odds” for Australia to return to average grain and oilseed production in 2019/20, the report said.

WHAT YOU NEED TO KNOW – SCIENCE, TECHNOLOGY & INNOVATION

The World’s Most Advanced Gut Microbiome Test is Changing Our Approach to Gut Health

Viome’s Gut Intelligence Test sends personalized dietary recommendations right to your phone.

You’ve probably noticed that TV doctors and natural health bloggers like to recommend all sorts of foods, beverages, and probiotic products that supposedly improve gut health. Unfortunately, while the science behind gut health is legit, a lot of these recommendations are not. Why? Because, just like the genome, everyone’s gut microbiome is unique, so what’s good for someone else might not necessarily be good for you. In reality, if you’re looking for a diet that promotes gut health, you need to start by taking a gut microbiome test such as the Gut Intelligence Test from Viome.

The human microbiome is the complex ecosystem of microorganisms that live in and on the human body. Over the last 15 years, scientists have discovered that this ecosystem plays a huge role in our overall health. And of particular importance is the gut microbiome, which is the community of symbiotic bacteria and other microorganisms that live in your digestive tract.