In This Week’s Issue…

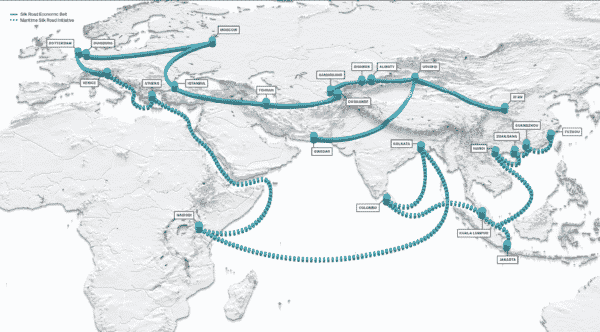

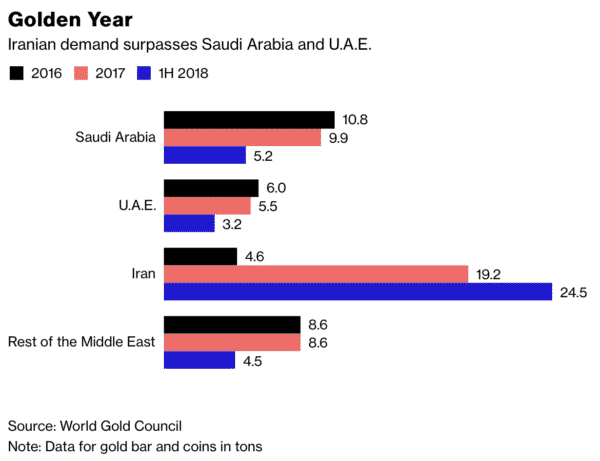

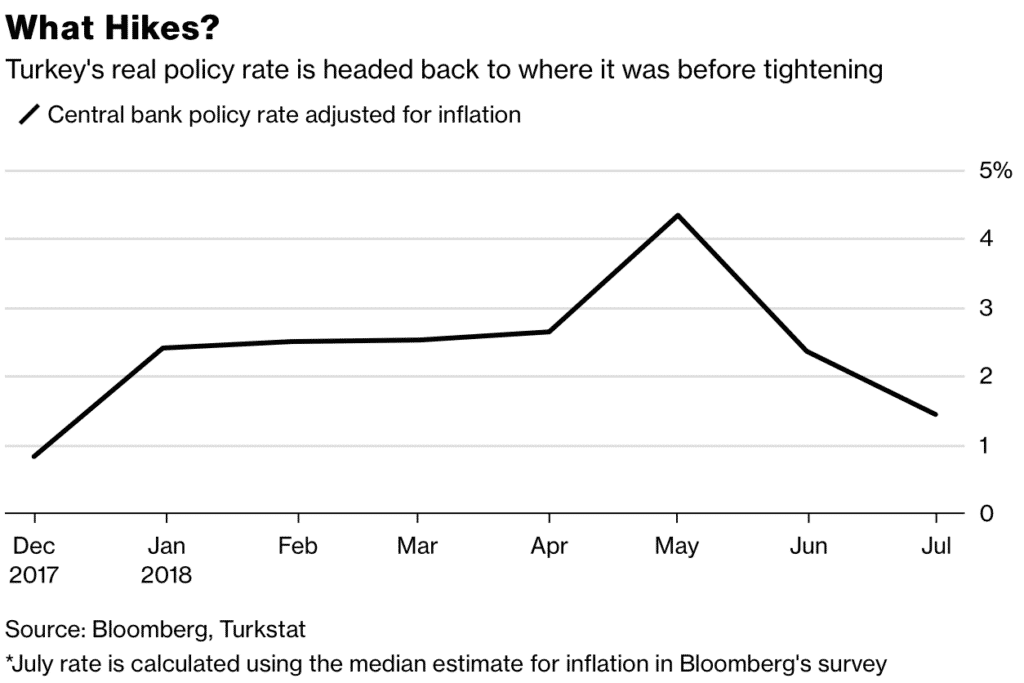

Tariffs, Sanctions

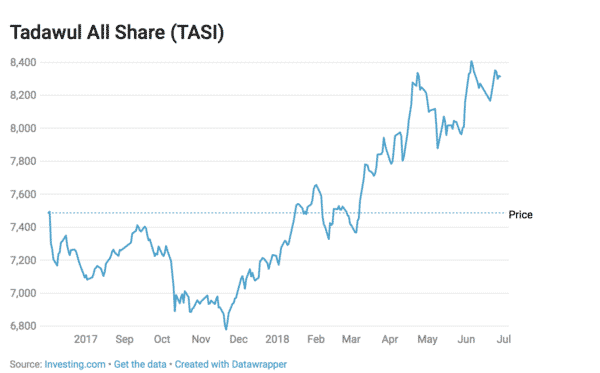

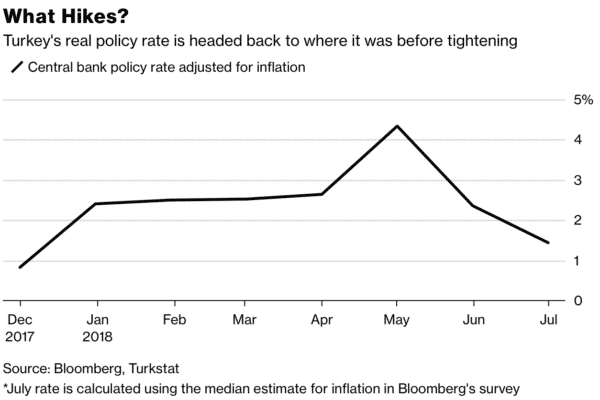

Markets in Asia continued their plunge, as a fresh round of trade war fears sent investors seeking cover. The move came after the White House confirmed that President Donald Trump asked U.S. Trade Representative Robert Lighthizer to consider hiking duties to 25 percent as early as next month. Turkey, meanwhile, is seeing its currency fall to a record low, stocks drop and bond yields rise after the U.S., a NATO ally, imposed unprecedented sanctions over the continued detention of a pastor.

India Hikes Rates Amidst Inflation

India’s central bank has served up its second consecutive interest rate hike, and there could be more to come. The Reserve Bank of India raised the rate at which it lends to banks from 6.25% to 6.5% on Wednesday, after hiking it for the first time in four years in June. India is growing faster than any other major economy but price rises are accelerating, and the stronger dollar isn’t helping. Overall inflation rate rose from 4.5% to 4.6% between May and June, while retail inflation edged up to 5% — significantly higher than the bank’s 4% target.

Khan He Do It?

Pakistan’s July 25 election, which brought the former cricket star Imran Khan into power as prime minister, was a landmark event. It marked the second consecutive peaceful handover of power from one democratically elected government to another in a country where coups are commonplace. Khan now confronts the daunting challenge of governing a fractious nuclear power of 220 million people with 39% poverty, chronic violence along its border with Afghanistan and a hulking national deficit. And he must do so under severe budget constraints and new constitutional restrictions on the power of the prime minister’s office.

Brazil Recovers For Now

Emerging market stocks were on fire last month and Brazil was the biggest beneficiary of that rally. Recent easing of trade tensions between the U.S. and some of its key partners improved sentiment around emerging markets and Brazil during the month. Most emerging markets are primarily export-based economies, meaning that increasing trade barriers directly impact their ability to grow economically. Brazil, for example, was the 24th-largest exporter in the world back in 2016. That year, Latin America’s biggest economy exported $191 billion in goods. Yet, Brazil is facing other threats with economic reform risking being the biggest loser in the country’s upcoming election. As Brazil faces its most unpredictable elections in decades in October, voters will have to choose between a wide array of economic platforms, from the liberal policies of Mr Bolsonaro to the anti-privatisation rhetoric of left candidate Ciro Gomes.